News

The government has announced that it will freeze the superannuation guarantee at 9.5% until 2021. Under previous plans, the super contributions paid by employers had been set to increase in 0.5% increments from the current rate of 9.5% until they reached 12% in 2019/2020. It will now be 2025 b...

By investing in fully franked Australian shares, SMSF (Self Managed Superannuation Fund) trustees can significantly reduce the amount of tax payable by their fund. This is because these shares are issued with a franking credit, also known as an imputation credit, which can be used to offset the tax...

As personal technology devices such as laptops, smartphones and tablets, are becoming increasingly prevalent, the ATO will be focusing its attention on individuals claiming tech items as work-related tax deductions. Currently, Australians claim almost $19.5 billion each year in work-related expense...

The sixth strategy in this business growth series is all about “margin”. In the previous four articles of this series we have covered: Increasing Customers and Clients Increasing Transaction Frequency Increasing the Transaction Value Effectiveness of the Sales Process Making thin...

Once again it is year end and businesses in the building and construction industry need to report the total payments they make to each contractor for building and construction services each year. Background As part of the 2011-12 Federal Budget, the government announced the introduction of taxable...

Did you know that your Ute, or Van may be subject to Fringe Benefits Tax? Firstly what is Fringe Benefits Tax (“FBT”) FBT is a tax that is payable on certain benefits that you either give or pay your employees and associates (ie wife or partner). This encompasses many things but today I am j...

The fifth strategy in business growth is about the ‘flow of your business’. In the previous four articles of this series we covered: Increasing Customers and Clients Increasing Transaction Frequency Increasing the Transaction Value Effectiveness of the Sales Process In th...

On the 6th of May I will be conducting a seminar with the Inner West Business Enterprise Centre to help setup businesses with Quickbooks Online. The seminar will be very practical with the goal for participants to leave with the cloud based accounting software, Quickbooks Online, up and running wit...

It is important that you take the time to focus on tax planning and the tax issues that affect you before 30 June 2014 arrives. Significant tax and cashflow savings can be created by a number of general tax planning strategies. Business Income and Expenses Subject to cash flow requirements, ...

The fourth strategy is generally about the overall effectiveness of your business. In the previous 3 articles of this series we have covered: Increasing Customers and Clients Increasing Transaction Frequency Increasing the Transaction Value The overall effectiveness of your business is ...

The ATO has recently released an app to help individuals and small business owners. You can use the new ATO app to: determine if your worker is an employee or contractor for tax and superannuation purposes search Small business assist to find relevant information and YouTube video explana...

As people get older they need to make arrangements on how to handle their estate, and their personal interests in the event of sickness or death. Contrary to popular belief, an individual’s parents, spouse or significant other are not always automatically empowered to make these decisions on thei...

You may recall we have already discussed the first two strategies to grow a business; ‘increase customers or clients’ and ‘increase the transaction frequency’. Let’s explore the next strategy: Increase the transaction value. This strategy is often referred to as t...

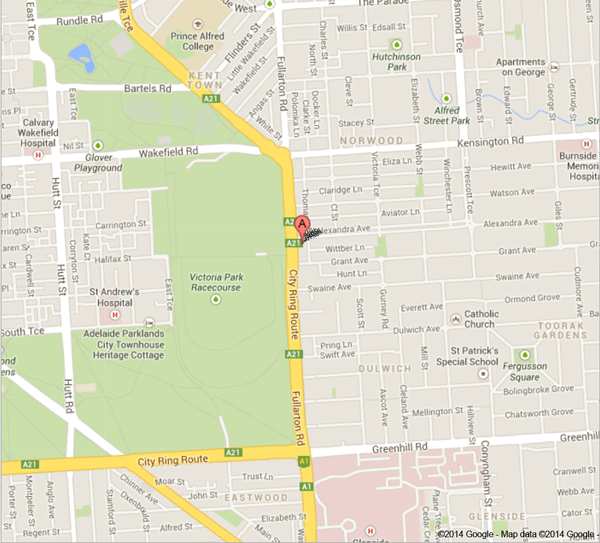

On Friday 28 February 2014 we will be moving approximately 400 metres north to Suite 4, 154 Fullarton Road, Rose Park. The 2013 year was an excellent year at BK Partners. Many clients referred their friends and business associates to us to support them with their business and accounting needs...

In the last article we looked at the strategy of finding new customers. The next strategy for increasing sales or income in your business is to increase the transaction frequency with your customers. Some experts believe that the most important strategy for business growth is to increase the s...

Most industry super funds offer members a basic level of personal insurance cover. Holding your insurance within super, rather than having stand alone policies (policies you pay for personally), can have its benefits. In a stand-alone policy you would typically pay premiums from after-tax earnings. ...

Read more: Paying for your insurance, should you use your superfund?

A new dependant tax offset allows individuals to claim an offset for invalids and carers. At the start of the 2012-13 financial year, the ATO made some changes to how individuals can claim offsets for dependants when lodging a tax return. One change is the eligibility age for the dependant tax...

You have probably heard this term in the medial lately, therefore I have added this article to provide you with a background of what they are referring to. The Federal Government has introduced changes to the superannuation system designed to make Australia’s superannuation system stronger and mo...

You may recall in my last newsletter the concept of only needing to focus on ‘three’ areas to help grow a business and improve its profitability. Many business development books and consultants argue there are numerous aspects to consider. However, if you think of any business strategy y...

The new Federal Government's plan to remove the Mineral Resource Rent Tax (The MRRT), also involves removing some tax benefits that are currently available to small businesses. Whilst the Federal Government had made this known in their commentary in the past, it is now Draft Legislation. In r...

As you all know I am a big supporter of the online accounting program Xero (www.xero.com.au) due to its simplicity of use, ability to access from any location, no data backups required, etc. Most importantly I can work with you in a more timely manner by being able to view the same data and inform...

In our past couple of editions we have discussed some foundation asset protection strategies and explored some of the misconceptions regarding various matters. We have also highlighted the need to obtain specific advice for your own situation before a problem arises. But, what if you are now faced ...

Many small business owners fall into the trap of building a business entirely dependent on them so that it would not survive if they were unable to work. They have not built a business rather, they've created themselves a job. Even worse a job from which they can’t resign or take extende...

As detailed in our May 2013 newsletter the super guarantee (SG) rate increases to 12% over seven years, as shown in the table below. 1 July 2003 - 30 June 2013 9% 1 July 2013 - 30 June 2014 9.25% 1 July 2014 - 30 June 2015 9.5% 1 July 2015 - 30 June 2016 10% 1 Ju...