News

Legislation is now in place from the May 2017 Budget where the Government announced a raft of proposals it hoped would relieve the pressure on residential property prices. Two of these measures are targeted at reducing the income tax deductions passive investors in rental residential properties can ...

Read more: The who, what and how of changes to deductions for residential rental properties.

Many people invest in property as a way of building wealth and, like all assets, there often comes a time when they need to be sold. And selling assets can cost you in the form of TAX! If you have lived in your own home – or principal place of residence (PPR) – for the entire time you own...

“Where did the profit go?” I hear it almost every day from the businesses I work with. Followed quickly by: “How did I make that much?” and “Why isn’t there more in the bank account?” You, like most business owners, are used to working hard and are good what you do but, when it come...

Many businesses suffer the problem of tight cashflow in the post-Christmas period. It’s not only the expense of the festive season; people are away, customers are recovering from holidays, and work can’t be completed. If you plan correctly now, there is no need to suffer from tight cashflow. T...

-

Upload PDF for Email:

Business Income and Expenses Subject to cash flow requirements, consider deferring income until after 30 June, especially if you expect lower income for 2016/17 compared to 2015/16. Most businesses are taxed on income when it is invoiced. Some small businesses may be taxed only when income is rece...

With year-end fast approaching and people consider contributing funds into superannuation it is important to consider the changes that have been proposed in the 2016 budget. Whist the changes are only proposed and subject to amendment it is important that you consider them as there is little polit...

Pre-budget speculation around changes to Australia’s current superannuation rules and tax concessions may be a cause for concern among some taxpayers. However, there are ways to best position yourself now for any potential changes to the superannuation system. Here are three options for indi...

-

Upload PDF for Email:

The ATO is targeting those who rent out their property for a few weeks during the year but claim a full year’s worth of tax deductions. The tax office will be paying close attention to rental property owners, especially those who own a holiday home, who incorrectly claim for initial repairs t...

Self-managed superannuation fund (SMSF) trustees should be aware of the new rules for holding investments in collectables and personal use assets that come into full effect on 1 July 2016. The new rules that were introduced 1 July 2011 have amendments to the guidelines for storage, insurance and va...

When renovating an investment property, it is important to keep in mind the taxation deductions available such as depreciation and capital works deductions. Investors seeking to renovate property that is used for income-producing purposes need to be aware of the tax-deductible expenses that can be ...

Employers must be able to differentiate between an employee or a contractor in order to meet their superannuation obligations. While employees work as a part of a business, contractors provide services to a business through their own business. Employers that fail to acknowledge this difference risk...

Read more: Superannuation obligations: employees vs contractors

SuperStream kick-starts on 1 July 2015 for businesses with less than 20 employees and you have until 30 June 2016 to meet the SuperStream requirements. The new reform simplifies employer superannuation contributions by requiring all businesses to make payments electronically to all funds. Small bus...

In the budget on 12 May 2015, the treasurer announced that small business will be able to immediately claim a tax deduction for assets costing less than $20,000 as opposed to currently being able to write off assets costing less than $1,000. What does this actually mean for you? Is this law y...

One of the most exciting things about starting a self-managed superannuation fund (SMSF) is the possibility of buying property. Property that you purchase in your SMSF can be transferred to you once you reach retirement age or retained in the SMSF where any income it generates will remain tax-free....

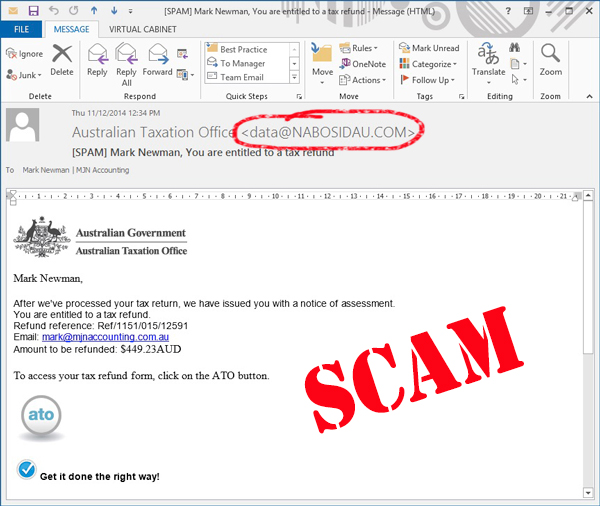

Good news everyone I am getting a tax refund! But wait … I haven’t lodged my tax return and I actually have to pay tax this year! Over the past few months I have received quite a few questions from people who have received emails from the ATO advising them they are entitled to a refund, I have ...

As of July 1 2014, there have been some changes to the concessional superannuation contributions cap, which is welcome news to the over 55's. The higher $35,000 concessional superannuation contributions cap, which was previously only available to people over the age of sixty, has now been extended ...

Read more: Make the most of transitioning to retirement — Important for people 55 and over.

It is an unfortunate fact of business life that sometimes you will not be paid in full for work you have done. When this happens you have incurred a bad debt, and it is a very frustrating experience. The silver lining to this situation is that there are some tax breaks that can come along with a ba...

1. What is a Self Managed Super Fund? A self-managed super fund (SMSF) is a superannuation fund with a maximum of four members who act as the fund's trustees and direct its investment strategy, giving Australians the chance to take a more active role in planning their retirement. SMSFs represe...

Read more: 7 Things you need to know about Self Managed Super Funds

The seventh strategy in this business growth series is about “margin”. In the previous articles of this series we have covered: Increasing Customers and Clients Increasing Transaction Frequency Increasing the Transaction Value Effectiveness of the Sales Process Making things Flow...

It is common for businesses to make GST errors in their BAS. The majority of these mistakes are unintentional. The ATO recently reviewed all of the BAS adjustments made as a result of auditing and revealed that over 80% were the result of inadvertent GST mistakes. Examples of common mistakes inclu...

The government has announced that it will freeze the superannuation guarantee at 9.5% until 2021. Under previous plans, the super contributions paid by employers had been set to increase in 0.5% increments from the current rate of 9.5% until they reached 12% in 2019/2020. It will now be 2025 b...

By investing in fully franked Australian shares, SMSF (Self Managed Superannuation Fund) trustees can significantly reduce the amount of tax payable by their fund. This is because these shares are issued with a franking credit, also known as an imputation credit, which can be used to offset the tax...

As personal technology devices such as laptops, smartphones and tablets, are becoming increasingly prevalent, the ATO will be focusing its attention on individuals claiming tech items as work-related tax deductions. Currently, Australians claim almost $19.5 billion each year in work-related expense...

The sixth strategy in this business growth series is all about “margin”. In the previous four articles of this series we have covered: Increasing Customers and Clients Increasing Transaction Frequency Increasing the Transaction Value Effectiveness of the Sales Process Making thin...