Taxation implications of selling of depreciating assets, such as vehicles or equipment

When going through the process of selling assets, many people are often surprised that there may be taxation payable on the sale even when they are trading for a similar asset. For example, trading one ute for another.

Why may there be tax payable in these circumstances? Read on to learn more.

Understanding depreciation

Depreciation on assets is a tax deduction to the business and reduces your taxable income. When buying an asset – depending on the value and when you purchased the item – you may have either:

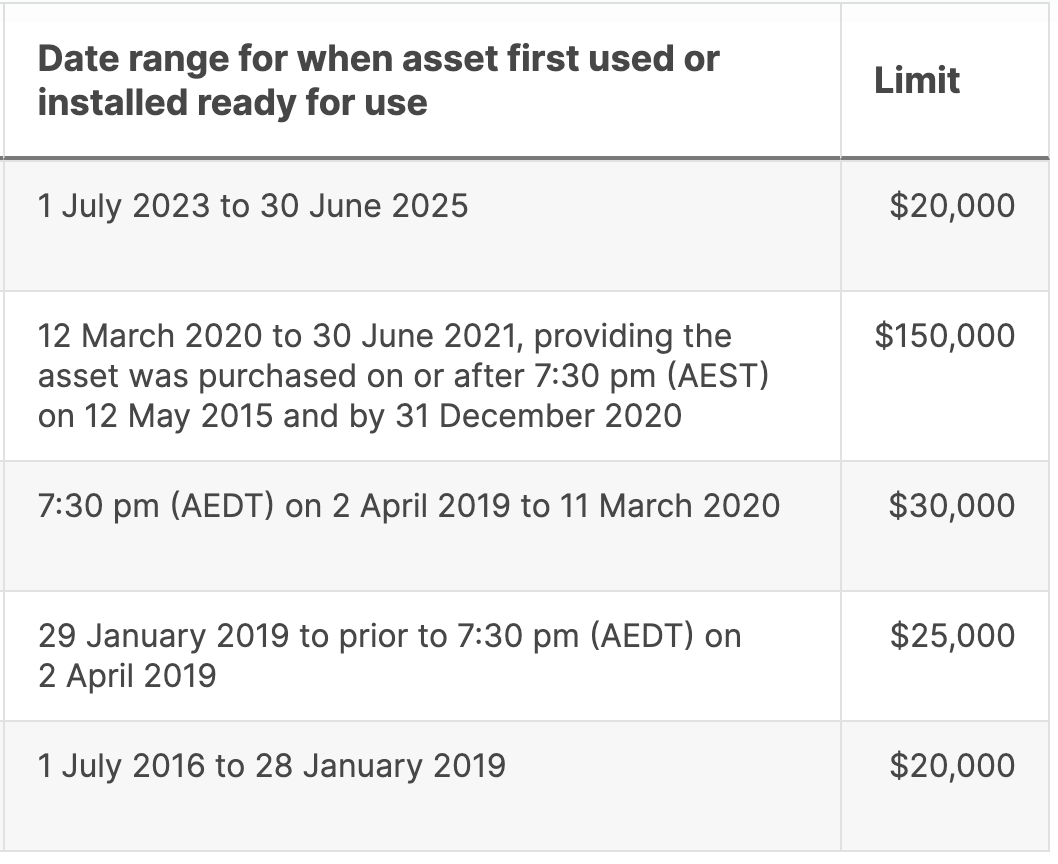

- Claimed the instant asset write-off (claimed it as a tax deduction in the year of purchase). For instance, during COVID there was an incentive to claim high-value assets of up to $150,000 as a full tax deduction in the year of purchase.

- Depreciated the asset over several years (based on ATO determine rates).

We are finding that people who purchased vehicles and equipment to take advantage of the instant asset write-off in 2021 (now five years ago), are now looking at trading items, which has taxation implications.

Source: Instant asset write-off for eligible businesses, ATO 2025

Calculating the asset's worth for tax purposes

It’s important to understand what the tax value is – which is what you paid for the asset, minus the depreciation claimed.

If the instant asset write-off has been claimed (if you have claimed the full value of the asset in the year of purchase), then the value for taxation purposes is $0.

If depreciated, then it is the cost of the asset minus any depreciation that has been claimed. As depreciation accumulates, the longer the item has been held the lower the value for taxation purposes.

You can work out the depreciated value by referring to the financial accounts, which show the historical value at a specific date, and then calculating depreciation to the date of sale, or alternatively by contacting your accountant.

Selling or trading an asset

If you are trading an asset – let’s say the changeover price is $19,000 and the instant asset write off threshold is $20,000 – does this mean that you can claim the $19,000 changeover price as a tax deduction? Unfortunately, no.

Although trading equipment or vehicles is often completed in one transaction, for tax purposes it is actually two separate transactions:

- The sale of the equipment you own

- The purchase of the new items

Sale of equipment you own

Let’s say you sell an item for $40,000 + GST. The sales value is $40,000 and to calculate the profit is simply a matter of subtracting the depreciated value from the sales price, as follows:

When instant asset write-off has been claimed:

| Sales Price | $40,000 |

| Depreciated Value | $0 |

| Taxable Profit | $40,000 |

When instant asset write-off hasn’t been claimed:

| Sales Price | $40,000 |

| Depreciated Value | $15,000 |

| Taxable Profit | $25,000 |

What happens if the asset is financed?

Using the above example, the finance payout is $40,000. As all the proceeds go toward paying off the finance, does this impact taxation? No, finance is only a method of paying for the item and has no implications on depreciation or profit or loss calculations on sale.

Purchase of new equipment

When the new item is purchased and ready to use, you will then be able to claim depreciation. If it is below the depreciation instant asset write-off threshold ($20,000 for the 2026 year) then you can claim the amount if full, if it is higher then you will need to depreciate.

How to calculate deprecation: let’s say the new item is $60,000 + GST. As the item is over the instant asset write-off amount, we claim depreciation as follows:

Depreciation = Cost x (Days held ÷ 365) x (100% ÷ Effective life (1) in years)

- Effective left, the ATO provides guidelines for example Motor Vehicles is 8 years, if you believe the asset will last for a different period you can self-assess and change this.

What is important is the purchase date. Two examples are as follows:

- Purchase date 15 July, (days held = 350), Depreciation claim is $7,192

$60,000 x (350 ÷ 365) x (100% ÷ 8) = $7, 19 - Purchase date 15 July, (days held = 5), Depreciation claim is $103

$60,000 x (5 ÷ 365) x (100% ÷ 8) = $103

Therefore, trading an asset near the end of the year may result in taxation liability from the profit on the sale, and as it would only be owned for a few days, limited deprecation can be claimed.

For more information on depreciation rules, visit the ATO's website.

If you need help navigating this in your business or wish to discuss this further, please contact us.