Proposed $3 million superannuation changes

There has been a lot of media attention on the government’s proposed $3 million superannuation changes, and subsequently questions from our clients on how these changes could impact them. Read our insights on this legislation below, to help understand whether your superannuation balance could be affected by increased tax.

At the time of this article’s publish date this legislation has not been passed; however we expect it will as the Labor government has sufficient parliament support.

The numbers and averages used in this article are examples from historical performance. If you have any questions about your specific circumstances, we recommend contacting your financial advisor, as we are not financial advisors and this is not intended as financial advice.

What do we know?

- The legislation applies to a superannuation balance of $3 million, per member (individual). A married couple could potentially have up to $3 million each, with a combined total of $6 million and would still fall within the $3 million cap.

-

The $3 million cap is not indexed, therefore as superannuation balances grow over time more people may be affected.

-

The extra 15% taxation is on the earnings of the fund for the proportion over $3 million. For example, if your superannuation balance is $4 million, it is applied to proportion of earnings on the $1 million over the $3 million.

-

Perhaps the most controversial aspect to this legislation is the tax applied to unrealised capital gains. For example, if the fund owns a property and this increases in value, the increase in value will be taxed and could cause cashflow issues for the fund to pay tax levy.

What do we need to consider?

The first thing to consider is whether your superannuation balance will reach $3 million. Most Australians (especially people currently aged 40+) are very unlikely to reach this balance, based on figures in this example:

- Aged 40

- Current superannuation balance of $200,000

- Historical performance (average growth in 15 years is 8.9%, statistic from superguide.com.au)

- Annual contributions of $15,000 increasing with salary increase at 4% per annum

At age 65, using the above calculations on various superannuation providers websites would result in a projected superannuation balance of between $2.4 million and $2.7 million before adjusting for any insurance (e.g. life insurance) costs, which would reduce the balance.

In these circumstances, while the individual’s superannuation total is close, it is still under the $3 million cap.

If my superannuation balance reaches $3 million, how will this impact me?

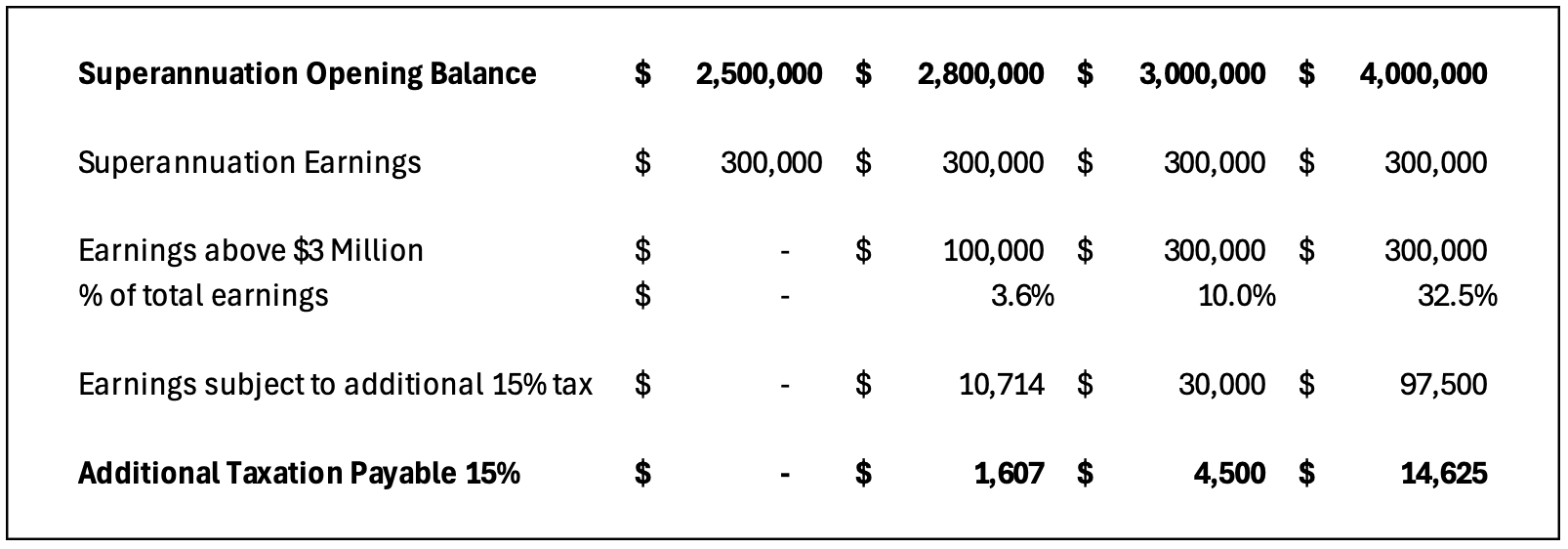

The taxation is only payable on the superannuation proportion of superannuation earnings above $3 million, not the entire earnings of the fund. This table summarises some examples of the taxation payable on varying superannuation balances:

Summary

With any taxation change, it is important to consider your personal situation, your future position and then undertake calculations of what the potential impact will be for you.

- The reality for most people aged over 35 is that this tax legislation will not impact them, unless they contribute significant amounts into superannuation over a long period of time.

- For the long-term, it is more likely to impact those 25 and under – for instance, in 40 years’ time.

- Coincidentally, capital gains tax was introduced 40 years ago and since then there has been significant change in the legislation. Similarly, we can expect to see significant change in this superannuation taxation legislation over the next 40 years.

Please remember, we are not financial advisors and this content is not intended as financial advice. Please consult with your financial advisor on the likelihood and impact it will have on you personally.