Payday Superannuation: Important information for employers

From 1 July 2026, employers will be required to pay their employees’ superannuation at the same time as they pay their wages.

For most employers, employee superannuation is paid quarterly. For instance, superannuation for the period 1 January 2026 to 31 March 2026 is required to be paid by 28 April 2026.

The change will result in employers paying their employees’ pay at the same time as their superannuation. Therefore, if your business pays your employees weekly you are now also required to pay their superannuation weekly.

Why is this being introduced?

Payday Super aims to address unpaid super contributions and help more Australians retire with the money they’re owed. More frequent payments will make it easier to identify incorrect or missed payments, and will help employers avoid building up financial liabilities they find difficult to pay.

Additional administration

Is this another time and administrative task that the ATO is imposing on employers, yes. However, most software providers – such as Xero – have updated their software to help simplify the process (we’ve documented this process at the end of the article).

To offer a real-time perspective; at BK Partners we have been paying superannuation with each pay cycle for two years and the process usually takes less than one minute each time.

What are the timing requirements for the superannuation payments?

The superannuation contributions are required to be received by the superannuation fund seven business days after the employee is paid.

It is important to remember that superannuation contributions are paid via a superannuation clearing house, of which you have no control over and this can take time to coordinate the payments.

The ATO has advised that if you make the superannuation payment the same date as your payroll they will deem the payment to be made in time.

How does this impact new employees?

For new employees, the contribution must be received within 20 business days. Therefore, if you allow approximately seven days for the clearing house to process, you will have 13 business days to make the payment for new employees.

The superannuation process for new employees is:

- They are offered a choice of fund form so they can select their own fund.

- If they don’t provide this then you can request details of their current fund “Stapled Fund” from the ATO.

- If they don’t have an existing fund then you need a “Default” fund you pay the superannuation into.

What happens if you pay superannuation late?

This is now calculated automatically by the ATO.

The ATO has the data to match from the payroll records, which is lodged with each pay run and the information from the superannuation clearing house.

Late payments will attract:

- administration fees

- daily interest

- penalties of 25% or 50% of the unpaid SGC, depending on any prior penalties.

Xero – Superannuation Payment Changes

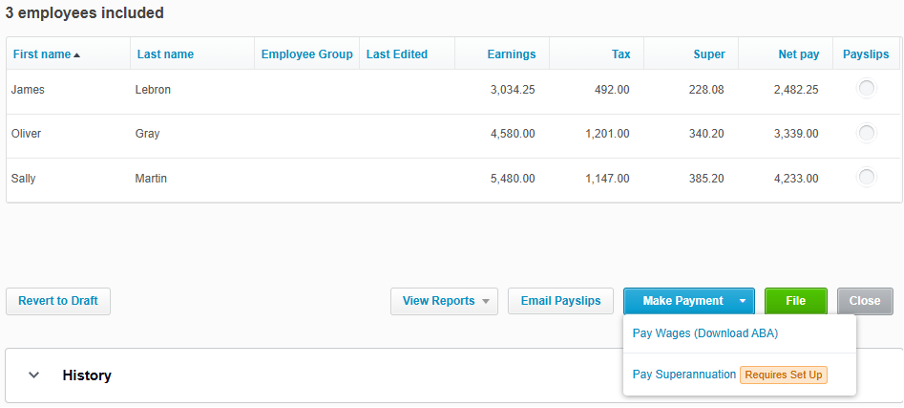

To facilitate the superannuation payment, Xero has now moved the ‘Pay Superannuation’ button to the same area as where you process the pay run.

Note: This screenshot is from the Xero Demo file, which is why you see the Requires Set Up comment. If you are already using Xero for superannuation this automatically transfers across.

Learn more about the Payday Superannuation legislation on the ATO's website.

If you wish to discuss this further, please contact us.