Is there tax on your superannuation when you die? The “death tax” explained

This article discusses the taxation implications on superannuation and death. It is not intended to be financial or investment advice; if you have specific investment questions we encourage you to contact your financial advisor.

For most people currently drawing down their superannuation from their fund, the amount that they receive is tax-free. For example, if you have $100,000 in your superannuation fund you can withdraw the $100,000 and this is tax-free to you.

But what happens if you die?

Firstly, it is important to understand the two superannuation contribution types:

- Concessional “taxed” contributions (amounts that have been taxed at 15%)

This is typically amounts that employer/s have contributed and amounts you have contributed and claimed as a tax deduction.

- Non-concessional “untaxed” contributions (no tax deducted)

Amounts that have been contributed into super and not claimed as a tax deduction. Examples of this include an inheritance deposited into super and downsizer contributions.

When receiving a pension from your superfund, the amount received is tax-free (in most circumstances) irrespective of the portion of the balance that has been taxed or untaxed in the fund over the years (note government superfunds can have different rules). Given this tax-free amount, people may not be aware of the breakup of their taxed and untaxed portions and implications when paying death benefits.

Superannuation paid to dependants and the tax implications

If you pass away and your superannuation is distributed to the tax dependants listed below – either via will or binding death nomination – the amount is tax-free to them (to reference our example above, they would receive the full $100,000, with no tax deducted).

- Your spouse

- Your children (under 18 years of age)

What happens if your children are over 18 years of age?

Non-concessional amounts

As these amounts haven’t been claimed as a tax deduction and no taxation paid in the fund, then these amounts are tax-free to the beneficiaries regardless of whether they are “tax dependants” or not (e.g. children over 18).

Concessional amounts

If these amounts are paid to either your spouse or children under 18 then the amounts are tax-free.

If they are paid to children over 18, then the amounts are taxed at 15% + 2% Medicare. For example, if you have $100,000 in superannuation paid to your 30-year-old child, this will be taxed at 17% and they would receive $83,000 after tax.

How you can avoid or minimise the 15% “death tax”

- Withdraw your entire superannuation balance from your superfund before you die.

While this is theoretically the most straightforward way to avoid the “death tax”, it is not necessarily a realistic scenario for most people.

- Recontribution strategy

The recontribution strategy allows people aged between 60-75 (subject to a condition of release for those between 60-65), to make tax-free capped lump sum withdrawals from their superannuation and then recontribute it back into their super fund, to change its tax status from taxable to tax-free.This means that the recontributed funds are no longer subject to superannuation death benefits tax, as their tax status has changed from taxable to non-taxable. This strategy requires careful planning and advice but if orchestrated correctly, is a simple and effective means of reducing or avoiding the “death tax”.

-

Reversionary pension

If a couple (spouses or de facto) are both in pension phase within the super fund, if only one person passes away there is an option to set up a reversionary pension. This redirects the pension of the deceased person to the other individual, allowing the funds to stay in superannuation and to be paid out tax-free on an ongoing basis.

What does a recontribution strategy look like?

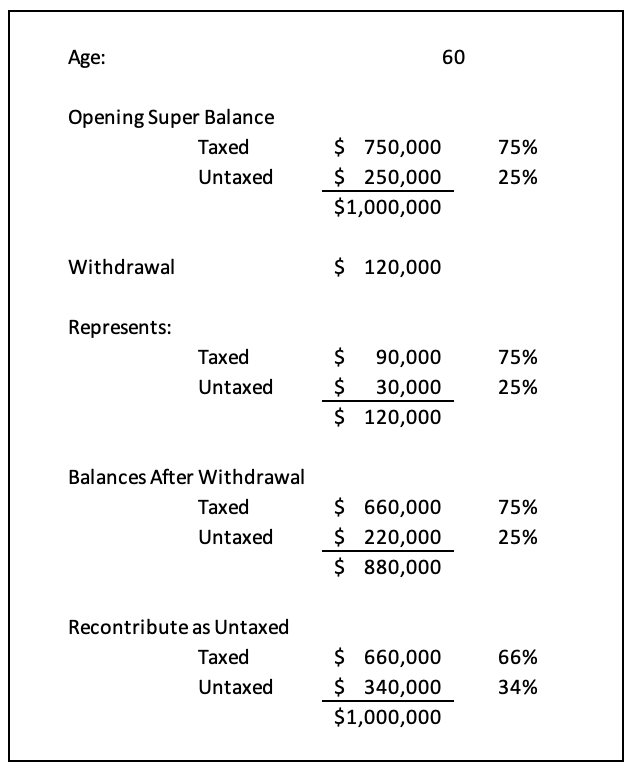

In this scenario, it is important to remember, if you have both taxed and untaxed amounts in your superannuation fund you cannot withdraw just one type. Any withdrawals are done in a ratio of both components.

Assuming:

- You have $1,000,000 in your superannuation fund, comprising $750,000 taxed and $250,000 untaxed amounts

- The non-concessional contribution cap is $120,000 per annum

- You are 60 and now retired (or can withdraw from superannuation)

How does this look, assuming no growth and all funds are recontributed?

Doing this for one year will convert the $750,000 of taxable funds to $660,000 taxable funds, which is a reduction of $90,000 and a potential death taxation savings of $15,300.

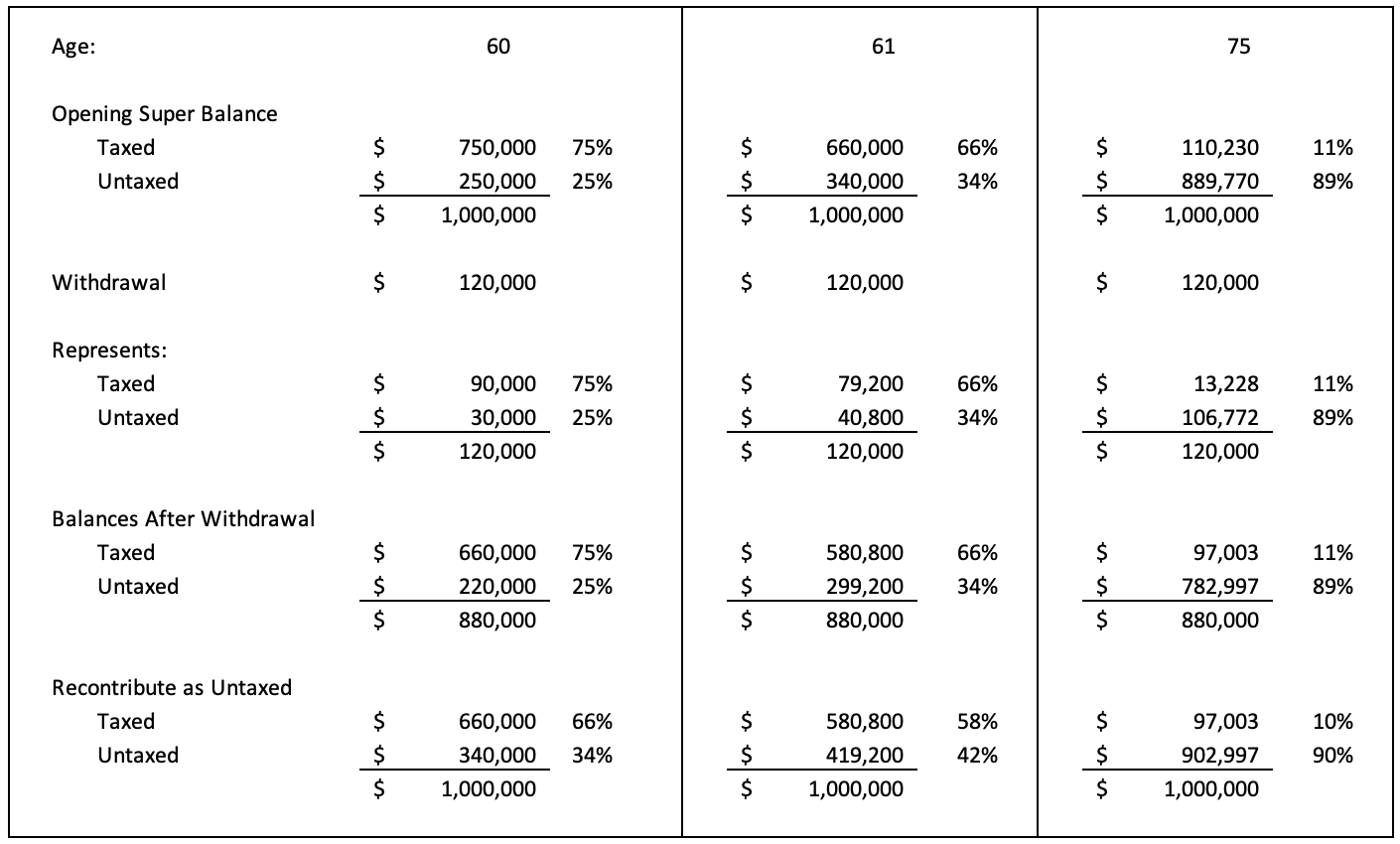

So what happens if you do this for 15 years until you are 75?

If the recontribution strategy was followed until you turned 75 (for 15 years in this scenario) and you were to draw out the amounts in a ratio each year – based on the starting balance each year – the taxable amount would reduce from $750,000 to $97,003. That is a reduction of $652,997, which at a “death tax” rate of 17% would save $110,009.

If you wish to discuss this further, please contact us.

We recommend consulting with your financial advisor for further advice about your specific circumstances.